August 23, 2023

Something I’m Reading

I just read "Taking Stock” by Jordan Grumet in one sitting and it was excellent. I read it in preparation for the podcast which will be coming out in the next month or two.

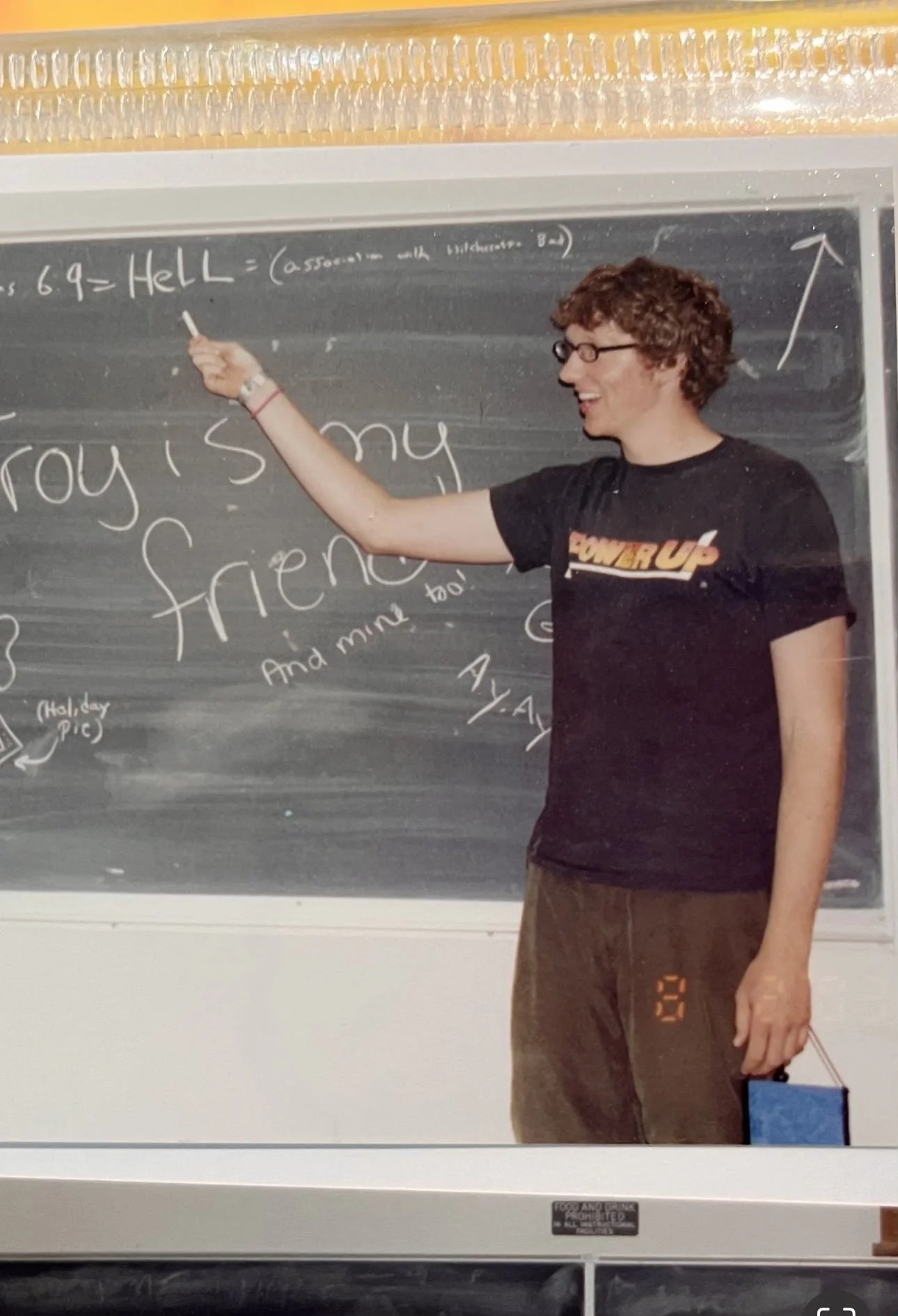

Something I Photographed

18 year old Brandon only shopped at thrift stores

Something I’m Excited About

Our latest investment opportunity at Open Door Capital, The Hill at Woodway apartments is now live! This exceptional 248-unit San Antonio gem is another assumable debt deal, so we’re locked in at 4.3% (yep, you read that right) for the next 6+ years! We’re already 90% subscribed to our “Class A” share class, but there’s still time to invest if you’re looking for a rock-solid opportunity that is completely passive. Shoot my team at text at 678-585-2719 to learn more!

Something I Can Answer

I’ll be answering two questions asked by a BTB subscriber. Have a question you want me to answer? Reply to this text with your question!

Question: "What advice would you give somebody is feeling stuck or uncertain about their path?”

First of all, recognize that it's often more important that you make a decision than what you decide. Don't get stuck in indecision. Indecision will rob you of the joy and happiness and success more and more than making the wrong decision. Secondly, don't just ask what's right for me? What am I supposed to do? What's my destiny? But instead, pretend you're a painter with a white canvas in front of you with a million paintbrushes and paints and you can create whatever you want. Paint a picture of your life way down the road and then reverse engineer it to figure out what you need to do next to get to where you want to go.

Question: "How do you evaluate the potential of short-term rental investments, such as vacation rentals or Airbnb properties, compared to traditional long-term rentals?”

I view short term rentals as a business, not as an investment. Even though it is an investment, it’s kind of both. I’m investing in the real estate, but then I’m actually treating it like a business. So as a business, I need to be 100% hands off so I can treat it like an investment. Or, if I’m going to be involved, it needs to pay me enough money to make it worth my time or worth the time of the employee I’m paying to run it. I also want to make sure with short term rentals that I’ve got exit strategies in case the laws change and I can no longer rent it short term.

So in other words, I need to be sure I can sell it or rent it out long term and be fine. And as a return, I would want to get an above average return on an Airbnb because of those increased risks of the laws changing and the amount of extra work and hassle that goes with it. I want to get an outsized return. So if I’m not making at least a 15% COC return, I probably wouldn’t be touching it.

If you’re interested in learning more about how I treat real estate like a business (allowing me to buy rentals in ANY market), join my free webinar on Aug 29 at 7pm ET. Register for FREE here.

Something I Recommend

Many of you know of my performance coach, Jason Drees. Jason has been my coach now for over 5 years and has helped me personally overcome some limiting beliefs, scale my business, and hit some crazy goals. The first step in hitting crazy goals is identifying them. Jason and his team are providing a complimentary impossible goal setting session – to help you uncover the impossible target you should be aiming it. Here is the link to get yours.

For my health-conscious friends (or those trying to be healthier), I’ve been using MyBodyTutor for years for accountability on my fitness and diet. These guys assign you a coach to hold you accountable, track your food, suggest exercises etc. You can check them out here.

Disclosure: “Some of the links in this post are affiliate links, which means I may earn a commission if you click on the link and make a purchase. However, please note that all opinions expressed here are my own and I only recommend products or services that I have personally used and found valuable."

Your Friend,

P.S. Comment below and let me know your thoughts on this week’s BTB! Please be friendly :)