September 11, 2024

Something I’m Reading

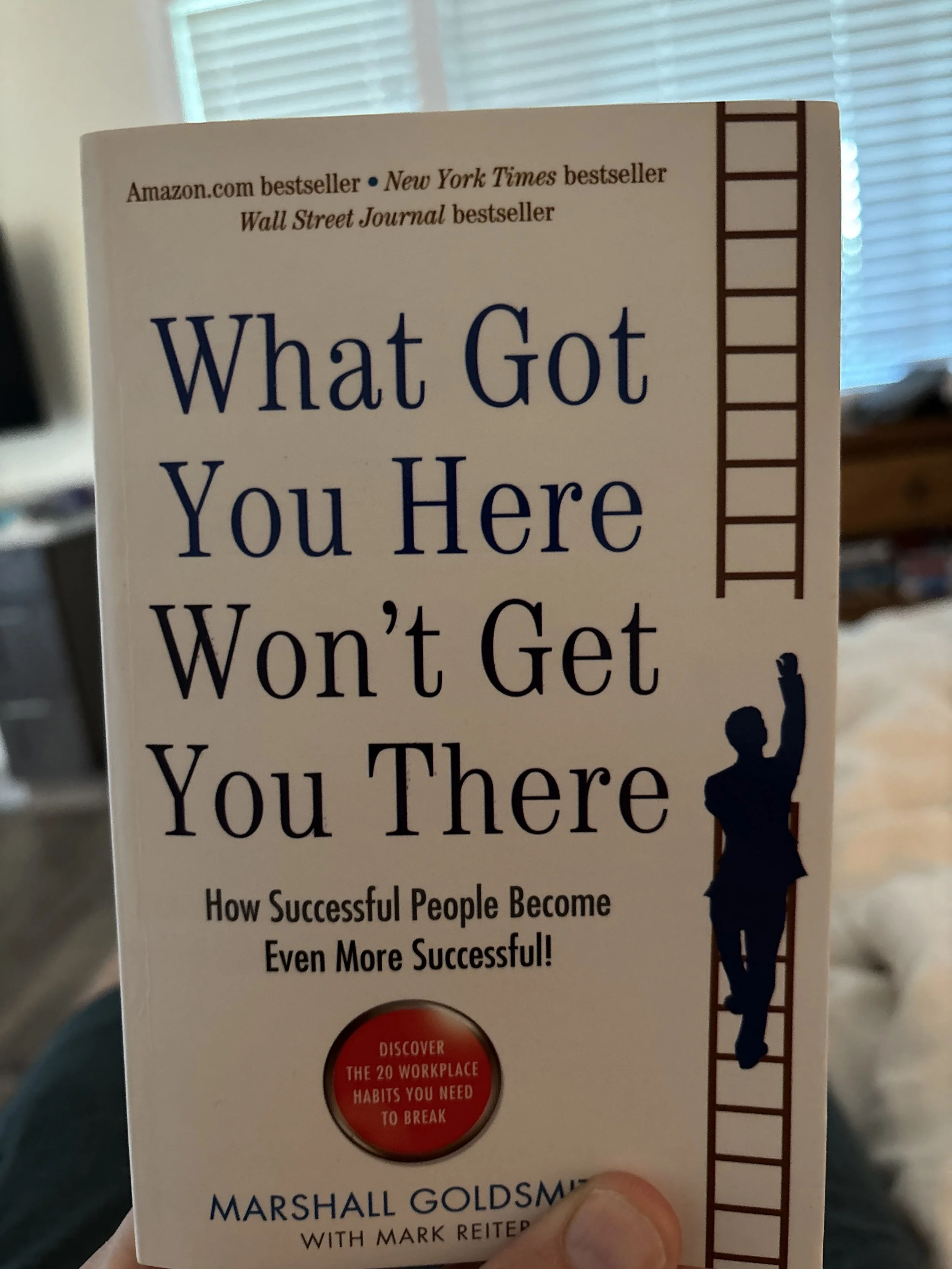

“What Got You Here Won’t Get You There” by Marshall Goldsmith

I’ve been meaning to read this book for almost a decade. A few chapters in and I realize this is exactly what I need right now in my career. Books are funny like that, right? “When the student is ready, the master will appear.”

Something I Photographed

One of the panels I got to lead at Limitless in Dallas!

Something I’m Excited About

I’m going to be filming a new video course for BetterLife Tribe members and First Deal students later this week. If you’re on either of those groups, you’re gonna love this thing.

Something I Recommend

I learned the hard way that managing tenants can be a nightmare without the right tools. That’s why I now use TurboTenant. It simplifies everything from background checks to credit reports, so I can avoid problem tenants from the start. Plus, it helps with marketing, custom leases, and automatic rent payments, making my life as a landlord so much easier. Don’t make the same mistakes I did. Use code Brandon10 for 10% off at TurboTenant.com/betterlife."

One of the most powerful tools in real estate is something surprisingly simple: a handwritten note. In a world full of emails and text messages, a personal touch stands out and gets results. Whether you're looking to buy your next investment property or reach more potential sellers, Ballpoint Marketing handles it all—from building targeted lists to crafting and sending personalized notes. Their 'done for you' service has been a game-changer for my business. For up to 15% off, visit BallpointMarketing.com/BetterLife. I don’t earn anything if you buy—I just believe in the power of their work.

Some Thoughts to (Hopefully) Make Your Life Better

Maximize Your Success by Using “The Lean Startup Methodology” to Real Estate Investing

When most people think of The Lean Startup (one of my favorite business books), they picture tech companies and Silicon Valley entrepreneurs.

But what if I told you that the principles outlined in Eric Ries’ game-changing book could be just as powerful in the world of real estate investing? That’s right—by applying “The Lean Startup” methodology to your real estate business, you can increase efficiency, reduce risk, and scale your portfolio more effectively.

At its core, The Lean Startup is about one thing: learning quickly through small, testable steps. Instead of spending years developing a product (or in our case, a real estate strategy) only to find out it doesn’t work, The Lean Startup encourages you to test your ideas quickly and cheaply. This approach allows you to learn from real-world feedback and make adjustments before committing large amounts of time or capital.

So, how does this apply to real estate investing? Let’s break it down into three key steps: Build, Measure, Learn.

1. Build: Start Small, Test Quickly

In real estate, building means taking action—whether that’s buying a small property, launching a direct mail campaign, or trying a new investment strategy. The key is to start with something small and manageable. Don’t go all-in on a massive apartment complex if you’ve never done a deal before. Instead, start with a single-family home or a duplex. Test the waters.

For example, let’s say you’re interested in flipping houses. Rather than diving into a large-scale project, start with a smaller flip. This allows you to build your processes—finding contractors, estimating repairs, managing the project—on a smaller scale. If the flip goes well, you can scale up. If it doesn’t, you’ve learned valuable lessons without risking your entire bankroll.

2. Measure: Gather Data and Feedback

Once you’ve taken your first steps, it’s time to measure the results. How did the project turn out? Did it meet your expectations? What went well, and what didn’t? The Lean Startup emphasizes the importance of data-driven decisions, and this is just as critical in real estate.

Maybe your first flip didn’t generate the profit you expected. Instead of seeing this as a failure, view it as a learning opportunity. Analyze what went wrong—did you underestimate repair costs? Overestimate the after-repair value? Use this data to refine your approach for the next deal.

3. Learn: Adapt and Improve

The final step is to take what you’ve learned and apply it to your next project. This is where the true power of The Lean Startup comes into play. By continually refining your approach, you’re able to improve with each new deal, reducing risk and increasing your chances of success.

For instance, if you learned that your rehab costs were too high, you might adjust by getting multiple contractor bids next time or by focusing on properties that require less extensive renovations. The goal is to build a real estate business that’s constantly improving, driven by real-world feedback rather than assumptions.

Conclusion: Lean Thinking for Real Estate Success

The Lean Startup methodology is all about efficiency, learning, and adaptability—principles that are just as valuable in real estate as they are in tech. By starting small, measuring your results, and constantly learning, you can build a real estate business that’s both profitable and scalable. Remember, it’s not about getting everything right on the first try; it’s about learning and improving with each step you take.

So, whether you’re a seasoned investor or just getting started, consider applying The Lean Startup principles to your real estate strategy. You might be surprised at how quickly you start seeing results.

Love you!

Disclosure: “Some of the links in this post are affiliate links, which means I may earn a commission if you click on the link and make a purchase. However, please note that all opinions expressed here are my own and I only recommend products or services that I have personally used and found valuable."